Insights

The payments market continues to be driven by innovation across the value chain from new consumer devices such as mobiles and wearables through to new processing standards such as tokenisation and HCE, and new business models such as those offered by Square and Stripe. Our structured research studies identify key trends and develop innovation case studies within the European payments market, the US and APAC, developing lessons learned and best practice models for clients looking to develop similar solutions.

Payments & SaaS - The New Batman & Robin for Fighting Financial Crime

Filling In the Gaps – Building a More Compelling Payments Proposition for SaaS/ISV Players in Europe

The Digital Euro – A Ghost Story

Nightmare on Acquiring Street

Merchant Enterprise F2F Payment Architectures Struggling

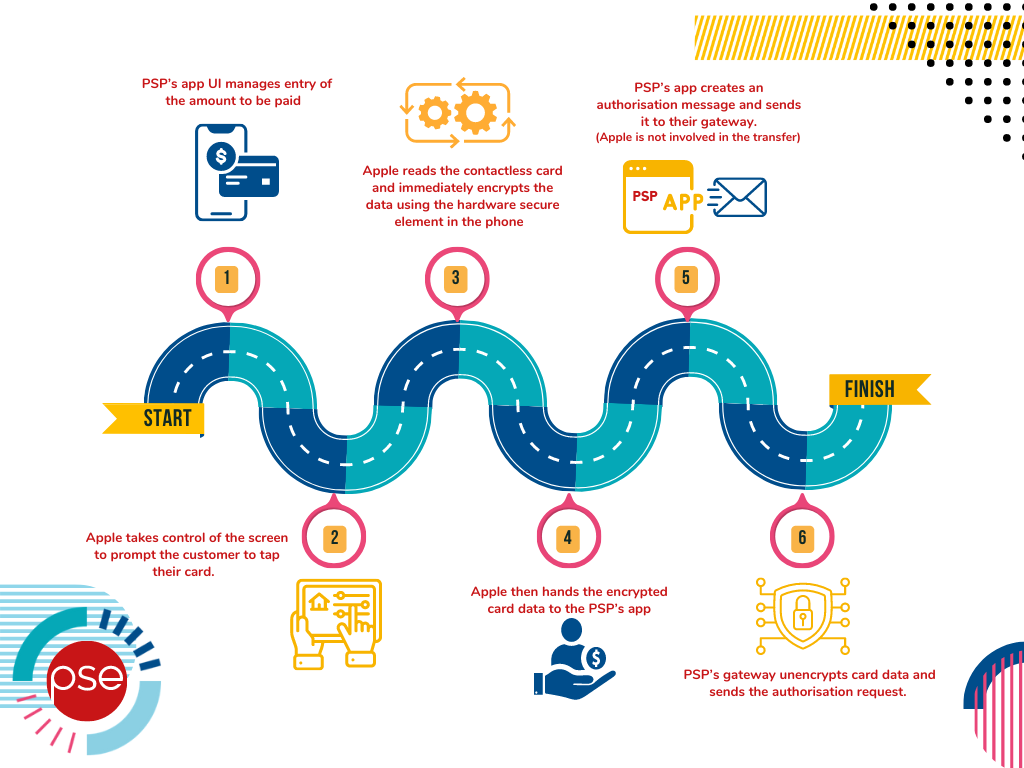

How to: Launch Apple’s Tap to iPhone Solution

5 years in the making: UK Open Banking finally gains momentum