5 years in the making: UK Open Banking finally gains momentum

5 years in the making: UK Open Banking finally gains momentum

It’s 5 years since the major UK banks began the roll-out of Open Banking. After billions of industry spend, we judge its performance as a payment product in the wider UK landscape. Do consumers’ want to use Open Banking given how much choice they already have? First we’ll compare it with another youthful product, BNPL, and then with the more traditional backbone of payments in the UK cards and Faster Payments.

Promoters of Open Banking (OB) cite some great statistics to show how far the product has come since its inception in January 2018:

- 7 million users (inc. 1.2 million first-time users)

- 8 million monthly payments

- 1 billion successful API calls every month

- 270 regulated providers of services

The UK payments market has built something to be genuinely proud of. It’s a world leading centre for Open Banking innovation with a raft of innovative players and products which have made the UK the centre of international attention. However, do UK consumers need the product and, most importantly, are they willing to switch their current payment behaviour across to Open Banking? Let’s have a look beyond the hype…

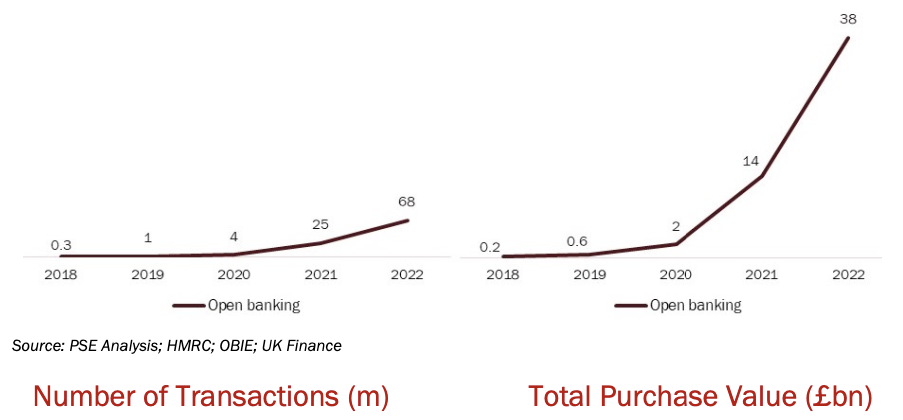

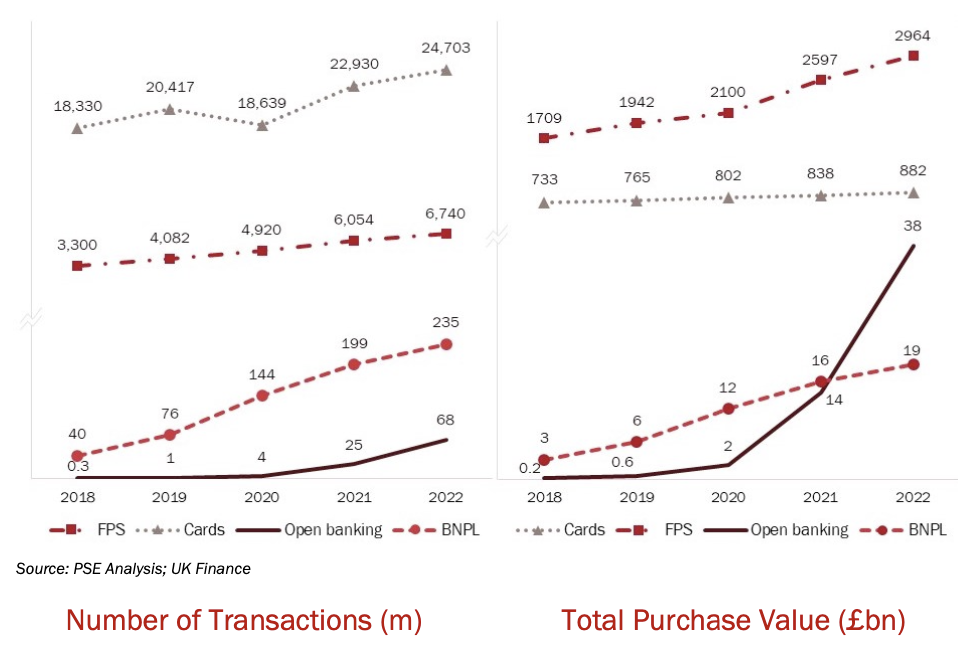

First, we need to have a look at the use of the OB product itself. Based on PSE’s analysis, users spent c.£38bn via Open Banking rails in 2022 across a base of almost 70m transactions. That’s an amazing achievement given that the product did not exist 5 years ago and has generated a blistering CAGR of 280%.

One of the great boosts for Open Banking has been the HMRC’s decision to roll-out Open Banking as a payment method. PSE is very pleased to have helped ensured OB was part of the UK Government’s framework contracts that underpin HMRC’s engagment with Ecospend1. HMRC’s transaction volume has also driven very high average transaction value (ATV) given consumers typically transfer £2,0002 when paying their taxes. Many people have compared this move to the decision by TfL in December 2012 to accept contactless cards which helped kick-start the contactless revolution in the UK. We’ll have to wait and see if the effect is the same. I remain a little sceptical. Consumers make lots of £5-£10 payments every week, but you can probably count the number of £2,000 transaction per annum on one hand.

These figures look fantastic, but how do they compare to the other new kid on the block BNPL? BNPL has certainly captured the interest of many younger people with an estimated 14m users in the UK (double OB’s user base of 7m3). It has also caught the attention of consumer groups and regulators, who are concerned about the emergence of an unsustainable debt bubble.

From a usage perspective, BNPL is a hands down winner, generating over three times as many purchases as Open Banking. However, we have to take care using these figures. BNPL is typically used in the fashion segment where the ATV is around £75-80 and therefore much lower than OB. It’s on the total spend side that the biggest surprise occurs (for me at least) because in 2022 OB overtook BNPL in terms of spend, with a meteoric increase in purchase value (see chart below).

As we look forward into 2023 and beyond it looks likely that OB will overtake BNPL across both spend frequency and value. Constraints on marketing spend, rising credit default rates, and impending regulation are all likely to constrain the expansion of BNPL. Meanwhile OB is not exposed to the credit cycle and is not as exposed to regulation. However, both products are contending with the collapse in FinTech investment which may limit the pace of customer acquisition, marketing spend, and innovation.

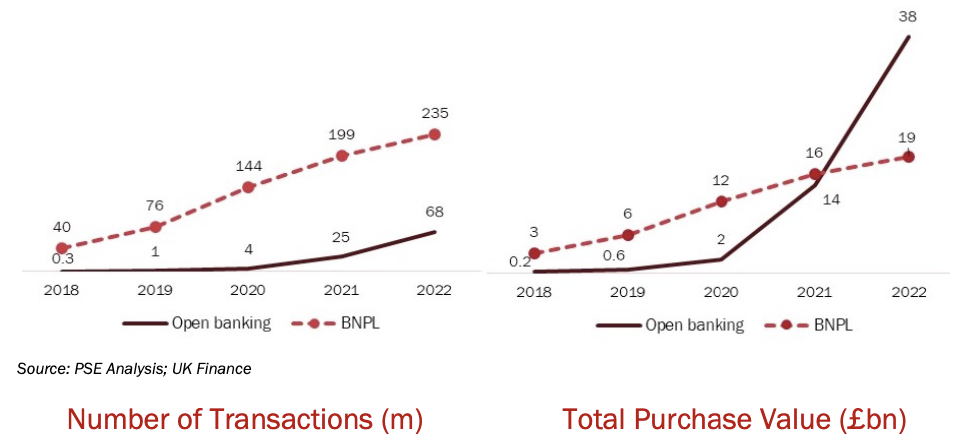

So, we’ve looked at the young bucks of the UK payments world, but let’s not forget the parents of the payments world i.e. traditional Faster Payment System (FPS) and cards. They are the default way to pay for UK consumers and, as you can see from the chart below this familiarity creates a very different scale of usage in the UK. They are both near-ubiquitous, free, and instant (as far as the consumer is concerned) as well as being widely understood/trusted. In the medium term it’s these payments that OB needs to displace if it is to be successful.

For every BNPL transaction in the UK, there are over 100 card transactions and for every pound moved via OB, there is over £110 moved via FPS. In the last 5 years card spend increased with a very modest CAGR of 5%, but FPS spend increased by 15% per annum. Over the same period, where Open banking added £26bn in spend, and BNPL £16bn, cards added £150bn, and FPS an eyewatering £1,255bn! Consumers are very familiar with these products, and it’s going to be hard to get them to change the core of their behaviours.

So, as we look into the future, where will OB’s growth come from? Despite its success, OB still has a number of challenges beyond its core single immediate payment use case. It still can’t support recurring at usable scale4, work effectively overseas, support chargebacks, or work in store, so there is still a long way to go before it can compete effectively with cards in the mass market. OB is most likely to displace high value bank-app pushed FPS transactions where it delivers a much better UX than key-entering details, remembering reference numbers etc. Even though OB requires every transaction to be authenticated, consumers are gradually getting use card-based 3DS2 processes in their day to day transaction habits, so this is becoming less of an issue. OB is still likely to see most success in very high ATV segments where consumers are already using bank-app based payments and merchants dislike card payments such as car purchases, wallet top-ups, and savings/investments.

As David Bowie said on the opening track of his ground-breaking 1972 album Ziggy Stardust “Five years, what a surprise” this analysis may be a surprise to some (including me). However, Open Banking has definitely carved a strong niche for itself and seems be overcoming the chicken and egg consumer-merchant adoption issue which often dogs the growth of new payment products. In addition, £3trn in annual FPS spend provides a very healthy runway for growth, so we look forward to continued success as consumers adopt the product as part of their general spend behaviour.

1. https://www.finextra.com/newsarticle/37400/hmrc-awards-open-banking-contract-to-ecospend

3. https://www.openbanking.org.uk/news/the-obie-marks-completion-of-cma-open-banking-roadmap-on-fifth-anniversary/ https://www.chargedretail.co.uk/2022/12/02/buy-now-pay-later/