.

This year, we covered a wide range of topics including: .

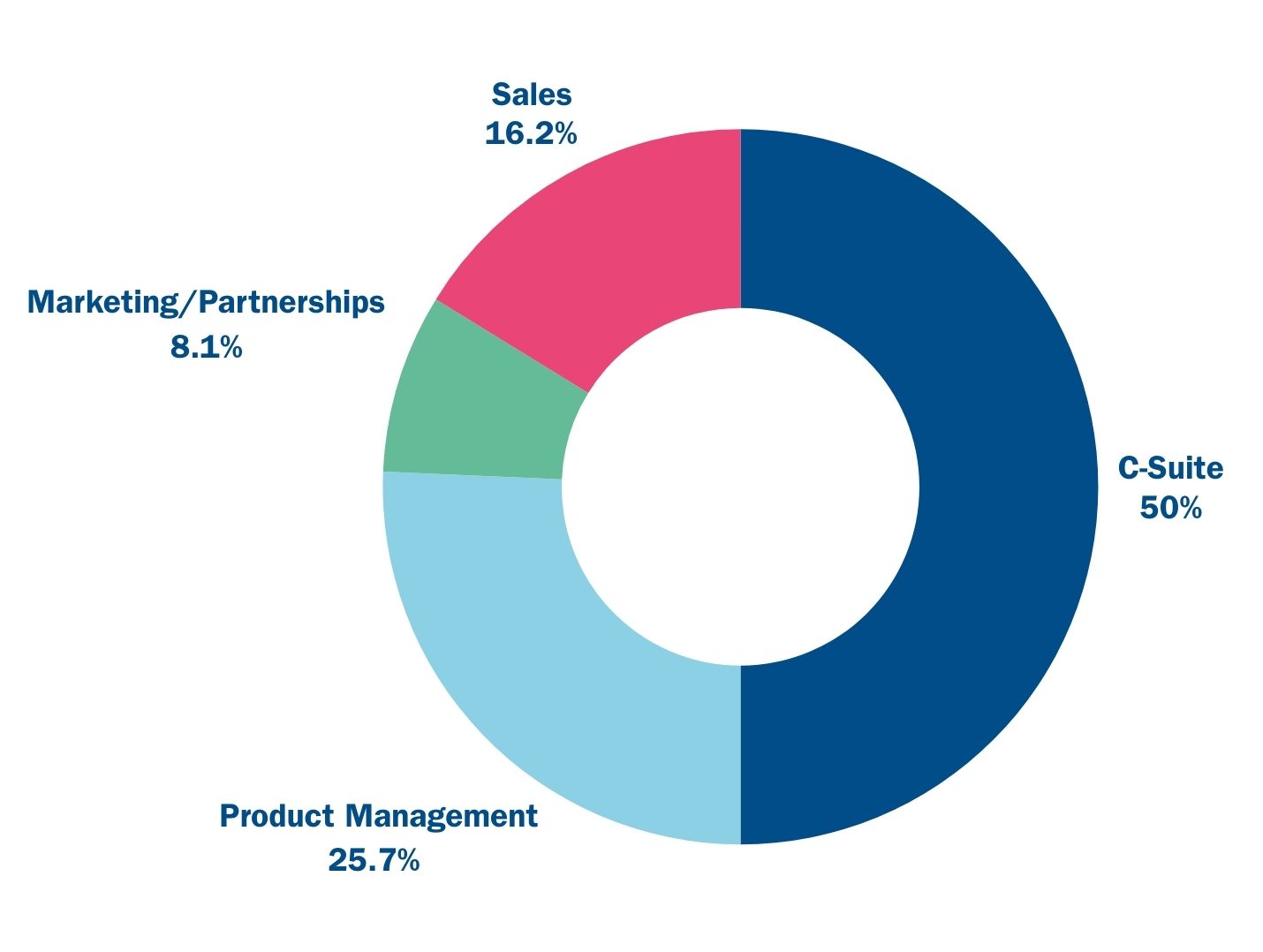

This year’s conference attendees represent a diverse and impressive range of expertise, bringing together professionals from various sectors of the payments industry. With a strong presence of C-suite executives, senior managers, and key decision-makers, the event provides a unique opportunity for strategic networking and collaboration. Sales and business development specialists, along with leaders in partnerships, marketing, and product innovation, ensure a dynamic exchange of ideas and insights. Attendees also include consultants, analysts, and experts in payments technology, further enriching the knowledge-sharing environment. The conference underscores its position as a premier platform for driving innovation, addressing industry challenges, and shaping the future of payments.

Here are the metrics showcasing the distribution of attendees by their roles:

The conference underscores its position as a premier platform for driving innovation, addressing industry challenges, and shaping the future of payments.